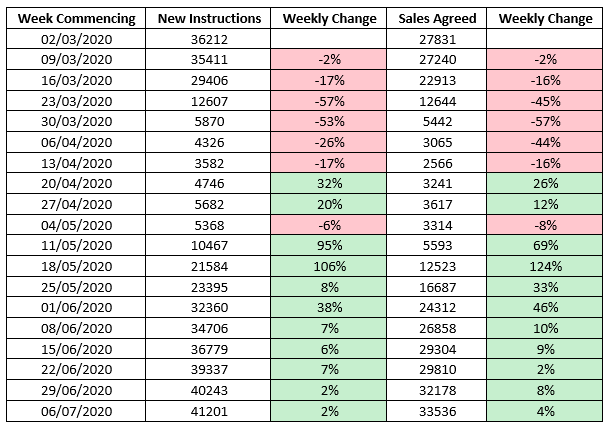

So, with fewer properties both coming onto the market last week as well as being sale agreed, I thought I’d look at some other parts of the housing market. But first, here’s how the UK Market looked last week, compared to the same week in 2019. As I’ve said before, we do usually see fewer transactions around this time of year on the run up to Christmas and New Year. Though, 2020 has been a totally different year for all of us on so many levels. Will it follow the historical path of previous years?

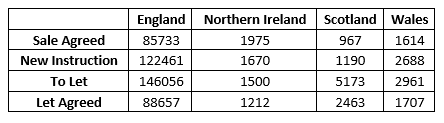

We’re still seeing considerably more properties entering the market for sale as well as those being agreed sales, than in the same time in 2019. But, both New Instructions and Sales have seen reduced numbers this week compared to last. Sales being agreed are still up around 46% on the same period of 2019 – just over 33,000 compared to around 22,500. So there are still a lot of buyers out there in the UK market looking at, and buying properties.

Now, what we also see, as probably you would expect, is that there are also 44% more properties in the sales pipeline than in November 2019 – 515,000 properties compared to 359,000 properties. With the current lag time between a sale being agreed and completion being over 5 months, on average, this means that the majority of sales happening now are likely to be completing in March 2021 at the earliest – when looking at the current average transaction lengths.

Of these 515,000 properties, 294,000 have not yet had their legal searches ordered, and so are still in the very early stages of the sale. As well as the almost 500,000 properties that are on the market, still to find buyers.

At the height of the initial lockdown at the beginning of May this year, there were only 256,000 properties with sales progressing. So this shows the remarkable recovery in the housing market in the UK. There are over double the transactions progressing!

However, with all these transactions in the pipeline and the current length of a transactions process, how many of these will reach completion before the end of March and the end of the current Stamp Duty holiday.